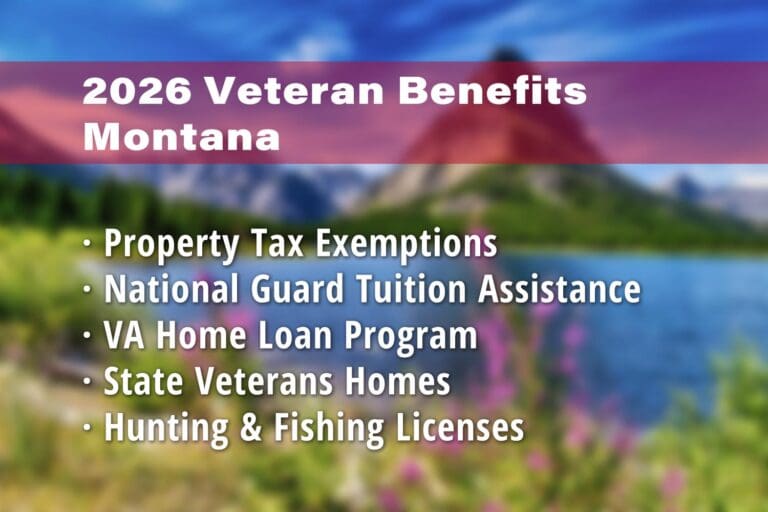

Montana Veteran Benefits

Montana Veteran benefits provide meaningful financial relief, education support, health care access, housing assistance, and community resources for those who have served our nation. From the Montana property tax exemption for disabled Veterans and VA home loan in Montana options to care through the Montana VA healthcare system and long-term support at a Montana Veterans home, these programs are designed to honor service while easing everyday costs. Many Veteran benefits are administered or coordinated through the Montana Veteran Affairs Division, helping Veterans and their families navigate eligibility, applications, and long-term planning. Key programs also include TRICARE for retirees in Montana, Veteran life insurance in Montana, Veteran auto insurance in Montana, life insurance for Veterans in Montana, employment preferences, and burial benefits. Together, these Montana VA benefits reflect the state’s commitment to supporting Veterans across every stage of life. Montana Veteran Financial Benefits Montana Veteran benefits offer a wide range of financial programs designed to reduce everyday costs and promote long-term economic stability for Veterans and their families. These benefits address major expenses such as insurance, taxes, debt management,