Veterans Are Unlocking Major Life Insurance Protection in 2025

Compare Plans and Get Coverage That Protects Your Family and Secures Your Legacy.

Navigating the world of life insurance as a Veteran can be overwhelming, especially with options like Veterans Affairs Life Insurance (VALife) and Veterans Group Life Insurance (VGLI) and the many others that all kind of sound the same. On the surface, these VA-backed programs might seem like convenient, safe choices. After all, they’re designed specifically for those who served, right? But here’s the truth: while these options might suit a small number of Veterans, they’re generally not the best financial choice for most. In this article, we’ll break down what VALife Insurance and VGLI really offer, why they might not be the best fit for your needs, and why the “buy term and invest the difference” strategy could be your ticket to a more secure financial future.

Veterans Affairs Life Insurance (VALife) is a whole life insurance policy introduced by the VA in January 2023. It’s designed to offer coverage to Veterans with service-connected disabilities who might struggle to find insurance elsewhere. VALife provides coverage from $10,000 to $40,000, and once you’re in, your premiums stay the same for life. Sounds decent at first, but as with most things, the devil is in the details.

Here’s the reality: whole life insurance, including VALife, isn’t usually the best choice for most Veterans. Or anyone who doesn’t use it as part of their estate planning really. Why? Let’s break it down:

Veterans Group Life Insurance (VGLI) is a term life insurance policy that essentially acts as a whole life insurance that you can convert from your Servicemembers’ Group Life Insurance (SGLI) after separating from active duty. You can choose how much coverage you want in $10,000 increments up until the maximum of $500,000 but it depends a bit on what you had with SGLI during active duty. Sounds like a pretty good and flexible option, right? But here’s where things get tricky since VGLI is basically like taking out a new 5-year term life policy upon entering a new age group.

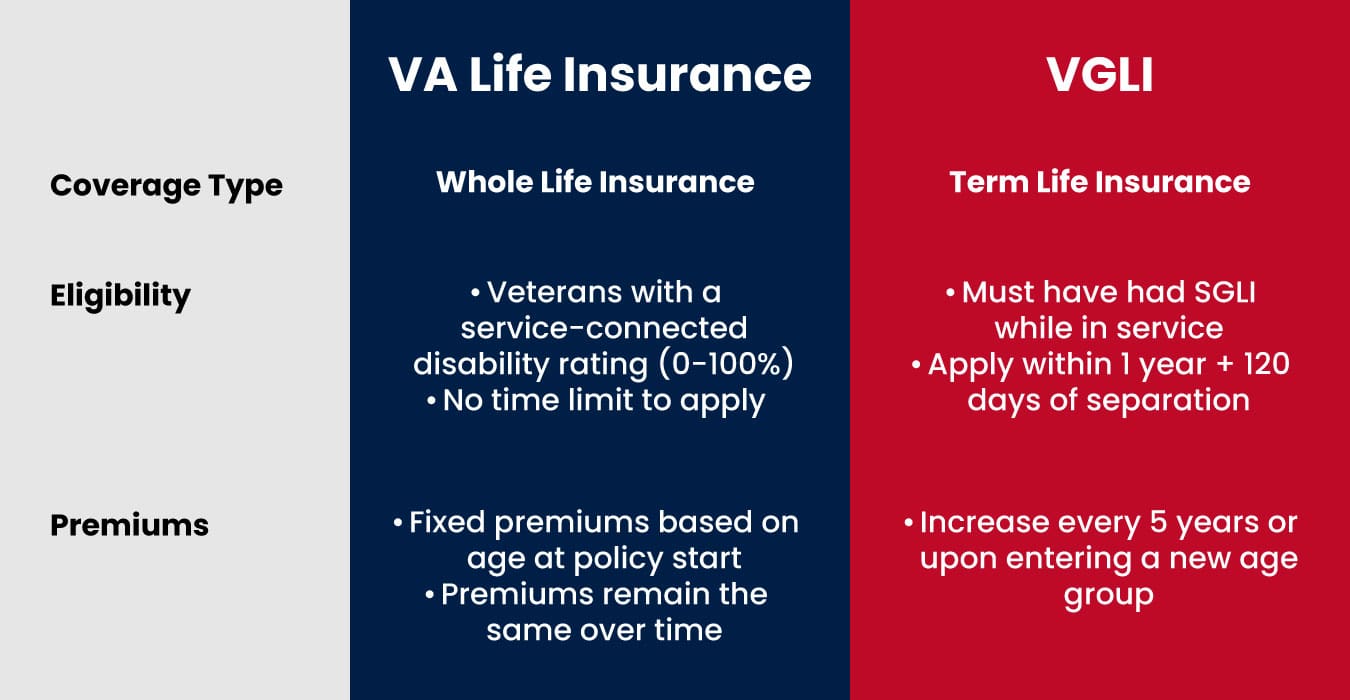

It’s easy to see why so many Veterans mix up VALife and VGLI—they’re both VA-backed, they both offer life insurance, and their names are pretty similar, and one policy tries to imitate the other. However, they couldn’t be more different.

Understanding these differences is crucial if you’re trying to figure out which policy, if any, is right for you.

Now you know the difference between VGLI and VA Life Insurance (VALife), let’s take a look at what the majority of Veterans actually should do to protect their family and leave them a sizeable inheritance: “buy term and invest the difference.”. You essentially insure your “working years” with term life insurance while you build up your own investments through something like a Roth IRA or mutual fund tracking a broad index like the S&P 500. You can read up on why buying whole life insurance is not even in the consideration and a bad choice here.

If you’re a disabled Veteran, you might be wondering if you can even get life insurance outside of VALife. The good news is that you probably can. Despite the myths floating around, most life insurance companies will insure disabled Veterans. In fact, even Veterans with PTSD can often get term life insurance, and yes, those policies generally pay out even in cases of suicide after a waiting period.

If you’re totally disabled (100%), you might have been eligible for a free life insurance for 100% disabled Veterans policy (S-DVI) before it was discontinued at the end of 2022. But unfortunately, VALife replaced this policy, and it doesn’t offer free insurance. It does however provide guaranteed acceptance for those with service-connected disabilities in case you really don’t qualify for any other insurance.

For most Veterans, though, term life insurance combined with smart investing is still the way to go, even if you’re dealing with a disability. The key is to shop around, get multiple quotes, and find a policy that works for you.

We know life insurance can be a daunting and confusing topic but it’s fairly simple if you know what you’re looking for. And while VA backed programs like VA Life Insurance or VGLI seem appealing, they’re often not the best choice for the majority of Veterans – even if they’re disabled as they come with high premiums, little coverage, and poor (no) returns. These policies could have been good and a real help to Veterans, but unfortunately, at the moment, they’re not.

Instead, you might want to consider the “buy term and invest the difference” strategy. It does not only offer lower cost, better returns and a greater flexibility but it’ll also make you become “self-insured” – meaning at a certain age your investments will far outweigh any potential life insurance death benefit.

Whether you’re about to separate from active duty or a Veteran looking to reevaluate your insurance needs – this approach is the key to protecting your family and building long term wealth. Remember, life insurance is only one part of your financial plan. It’s insurance. Nothing else. Like it would be with your home insurance. You’re building your financial home yourself – the insurance is simply protecting it.

Disclosure: Brave Veteran is a private website and is not approved, endorsed, or affiliated with the U.S. Government, the Department of Defense, the U.S. Armed Forces, the Department of Veterans Affairs, or any other government agency. The products, services, and information offered on Brave Veteran are independent and not provided or reviewed by any government entity. Brave Veteran is supported by advertising, and we may receive compensation from companies whose offers appear on this site.

© 2026 braveveteran.com All Rights Reserved