Veteran Life Insurance: A Comprehensive Guide to Your Veterans’ Life Insurance Options

Veterans Are Unlocking Major Life Insurance Protection in 2025 Compare Plans and Get Coverage That Protects Your Family and Secures Your Legacy. How Much Life Insurance Coverage Do You Need? $100,000 Protect My Family Today Navigating the world of life insurance as a Veteran can be overwhelming, especially with options like Veterans Affairs Life Insurance (VALife) and Veterans Group Life Insurance (VGLI) and the many others that all kind of sound the same. On the surface, these VA-backed programs might seem like convenient, safe choices. After all, they’re designed specifically for those who served, right? But here’s the truth: while these options might suit a small number of Veterans, they’re generally not the best financial choice for most. In this article, we’ll break down what VALife Insurance and VGLI really offer, why they might not be the best fit for your needs, and why the “buy term and invest the difference” strategy could be your ticket to a more secure financial future. Understanding the new Veterans Affairs Life Insurance (VALife) What is VALife? Veterans Affairs Life Insurance (VALife) is a whole life insurance policy introduced by the VA in January 2023. It’s designed to offer coverage to

Is there free life insurance for 100% disabled Veterans?

The short answer is no. There is no free life insurance for 100% disabled Veterans. Not anymore at least. There used to be a VA backed policy for free life insurance for 100% disabled Veterans called “S-DVI” or Service-Disabled Veterans Life Insurance up until December 31, 2022. Unfortunately, this program got discontinued when the VA launched their new “VA Life Insurance” program and as of right now there is no free life insurance for 100% disabled Veterans – or any rating for that matter. There are however a lot of very affordable life insurance programs for all Veterans that extend coverage also to disabled Veterans. If you already have free life insurance for 100% disabled Veterans you can keep the policy as is, you don’t have to do anything. Are all S-DVI policies free for disabled Veterans? No, only those Veterans who are totally disabled (100%) were able to receive a waiver for the premium on their policy. For everyone else the premium depends on their age, amount of insurance, coverage plan and whether your billing is set to monthly or annually as the VA gives a slight discount to all annual billings. What are your options

VA Life Insurance (VA Life) and why it’s a bad choice for the majority of Veterans

Veterans Affairs Life Insurance or “VA Life” Insurance is an insurance policy provided directly through the VA. It’s a whole life insurance policy with the death benefit ranging from $10,000 to $40,000. VA Life Insurance is the VA’s first new life insurance policy in almost 50 years and was established in January 2023. The idea behind it is to help eligible Veterans with service-connected disabilities to gain access to a whole life insurance policy that they can qualify for. At first glance this seems like a good deal, however it’s important to understand why the concept of whole life insurance is disadvantageous for the majority of Veterans – even in old age and/or when they have a service-connected disability. Keep on reading to understand why this is such a bad policy and to understand the difference between VA Life Insurance and VGLI (Veterans Group Life Insurance). VA Life Insurance (VA Life) is often confused with Veterans Group Life Insurance (VGLI) Many Veterans and other people confuse VGLI and VA Life Insurance with one another because of the similar name. However, they couldn’t be more different. One policy, the VA Life Insurance is whole life insurance while

Veterans’ Group Life Insurance (VGLI): VGLI Rates, Coverage and Application

The Veterans’ Group Life Insurance (VGLI) is a life insurance policy offered explicitly to Veterans that allows them to continue with the SGLI coverage after dismissal from the service. This program guarantees that Veterans are insured as long as they continue paying premiums for their policy, unlike the traditional term life insurance with a fixed expiration time. This continuity can be essential for the post-services Veteran who does not qualify for any private insurance policy. However, we should already note that VGLI is not a good life insurance policy in general and most Veterans are far better off cancelling their VGLI policy with the VA if they transferred from SGLI into VGLI and get a private term life insurance policy instead if they’re able to qualify. The same applies if you don’t have a VGLI policy yet. You can skip to here where we explain why VGLI is a bad choice for the majority of Veterans. The VGLI program provides coverage in increments of $10,000 from $10,000 to $500,000, depending on the veteran’s coverage under SGLI and what plan they chose upon transferring their SGLI into VGLI. Editor’s Note: Effective March 1, 2023, the maximum amount of

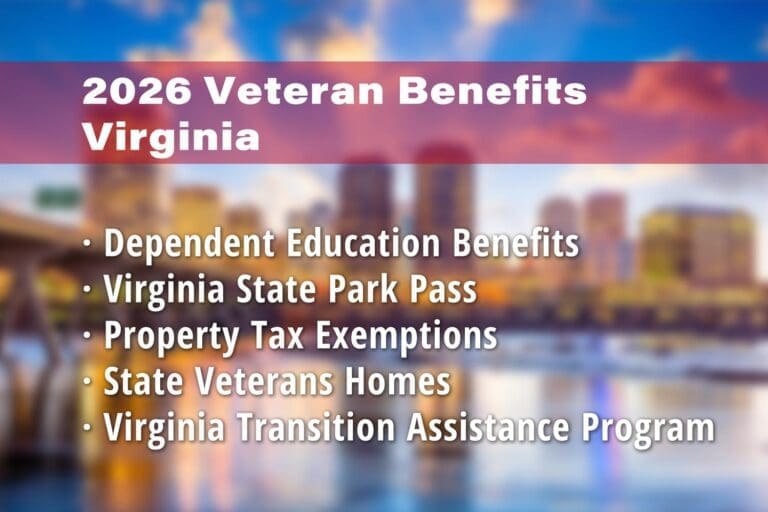

Virginia Veteran Benefits

Virginia is a strong supporter of the United States Armed Forces and its Servicemembers. Virginia is home to numerous military installations, including Naval Air Station Oceana, Fort Belvoir, and Marine Corps Base Quantico, among many others. To show the state’s appreciation for its military residents, Virginia offers various benefits to Veterans, including property tax exemptions for disabled Veterans, tuition assistance for spouses and children of qualifying Servicemembers, employment assistance, and hunting and fishing license privileges. The Virginia Veteran benefits system provides such perks as Virginia dependent education benefits, Virginia survivor benefits, and Virginia income tax exemption for Veterans. There are even more benefits available to Virginia Veterans. Virginia Veteran Financial Benefits Virginia offers several financial benefits to Veterans, including the Virginia property tax exemption for Veterans, VA home loans, and assistance with vehicle registration and sales taxes. The State of Virginia Veterans benefits looks to work in partnership with federal financial programs for Veterans through the VA as well. Some other financial benefits include free use of toll facilities, as Veterans who have been rated by the U.S. Department of Veterans

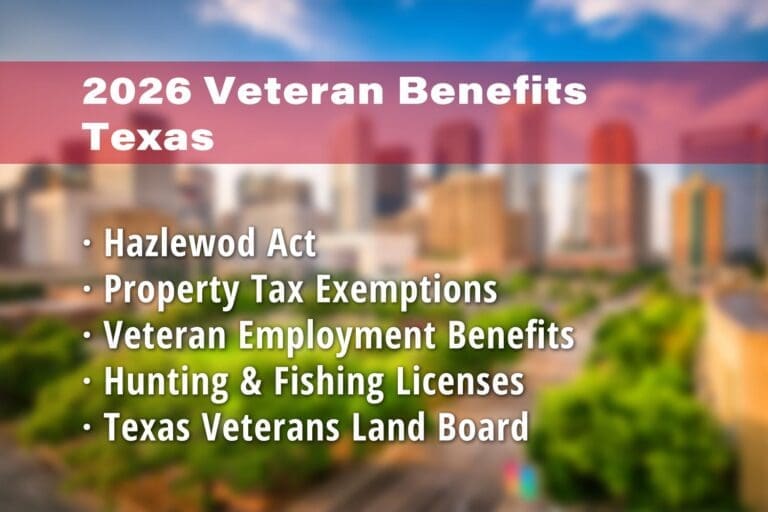

Texas Veteran Benefits

Texas is quite proud of its many contributions to the United States Armed Forces in the way of personnel, military bases, and benefits to its Veterans. In an effort to honor its resident Servicemembers, the state offers several Veterans benefits for Texas such as Veteran home loans, a special Texas state park pass, Texas disabled Veteran benefits, disabled Veteran property tax exemption, Hazlewood Act education benefits and Veterans Texas hunting license. Keep reading to learn more about these Texas Veteran benefits. Texas Veteran Financial Benefits Texas offers many financial benefits to Servicemembers in addition to VA programs through the Texas Veterans Commission. Disabled Veteran Property Tax Exemption The disabled Veteran property tax exemption excludes disabled Vets from certain taxes through its homestead tax exemption Texas program. For example, Veterans with a percentage disability issued by the VA qualify for the Texas disabled Veteran property tax exemption. In Texas, Veterans with a disability rating of: 100% are exempt from all property taxes in the disabled Veteran property tax exemption. 70 to 100% receive a $12,000 property tax exemption. 50 to 69% receive a

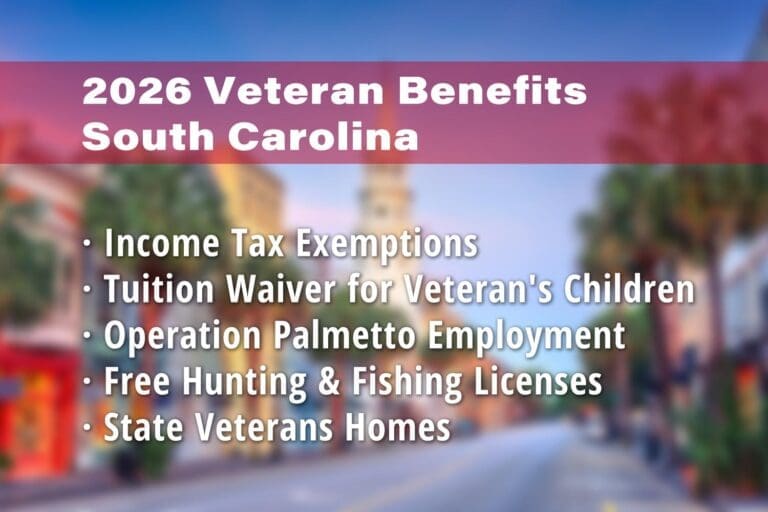

South Carolina Veteran Benefits

South Carolina is a state that honors its Veterans through a variety of supportive programs and opportunities. Some of these benefits include tax exemptions, employment preferences, educational assistance, and access to state services and resources. There are also opportunities through South Carolina Veteran benefits programs for the SC VA tuition waiver, the SC tax exemptions for disabled Veterans, and a special South Carolina hunting license for Veterans. The Veterans Administration Columbia South Carolina Office also works in conjunction with state-level Veterans services to bring these benefits to South Carolina Veterans and Servicemembers. South Carolina Veteran Financial Benefits South Carolina offers various financial benefits to Veterans, including property tax exemptions, income tax deductions for military retirement pay, state employment preference, and free hunting and fishing licenses for disabled Veterans, as well as tuition assistance for certain war Veterans’ children. Some South Carolina Veterans benefits include the SC tax exemption for disabled Veterans, as well as the South Carolina disabled Veteran property tax exemption. Disabled Veteran Property Tax Exemption Veterans who have a total and/or permanent service-connected disability qualify for several disabled Veterans

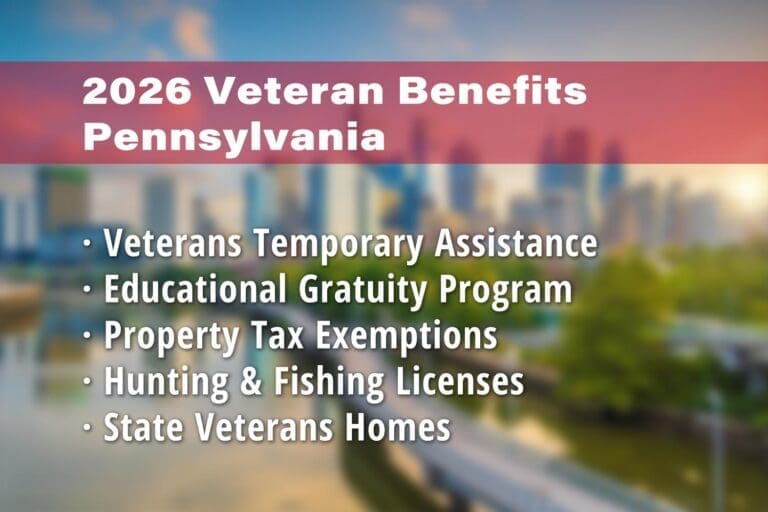

Pennsylvania Veteran Benefits

Pennsylvania is a historic state with many contributions to American history, and the state is quite proud of its military heritage going all the way back to the Revolutionary War, when militiamen guarded Philadelphia as the Declaration of Independence was signed. Today, the state has a rich modern military system that, while not as extensive as other states, still proudly provides military installations such as Fort Indiantown Gap, the Carlisle Barracks, and many programs of support for its resident Veterans. Pennsylvania offers Veterans a range of benefits, including financial assistance, educational opportunities, and tax exemptions, as well as specialized programs for disabled Veterans and their families. Some of these Pennsylvania Veterans benefits include specific Pennsylvania disabled Veteran benefits, the PA Veteran property tax exemption, the PA Veterans income tax exemption and the Pennsylvania State Park Pass for Veterans, among others. Read on to learn more. Pennsylvania Veteran Financial Benefits Pennsylvania provides several financial benefits to Veterans, including emergency assistance for necessities, educational gratuity, real estate tax exemptions, and pensions for blind and paralyzed Veterans, among other Pennsylvania Veteran

North Carolina Veteran Benefits

North Carolina is one state that has a multitude of military operations within its borders, and as a result, many in-state residents are Servicemembers and Veterans. North Carolina has multiple military installations, including Fort Liberty (formerly Fort Bragg), Marine Corps Base Camp Lejeune, Marine Corps Air Station Cherry Point, and Marine Corps Air Station New River, among others. The state offers Veterans numerous state-level benefits, including property tax exemptions for disabled Veterans, state employment preferences, discounted hunting and fishing licenses, and in-state tuition for Veterans and their dependents. North Carolina Veterans have access to such perks as the North Carolina property tax exemption for Veterans and the North Carolina hunting license for Veterans, for example. Read on to learn more. North Carolina Veteran Financial Benefits The state of North Carolina has many state-level financial benefits that work in conjunction with federal financial programs for Veterans. Some of these state-specific North Carolina Veteran benefits include the North Carolina property tax exemptions for Veterans, state employment preferences, vehicle registration benefits, and the North Carolina income tax exemption for Veterans, among

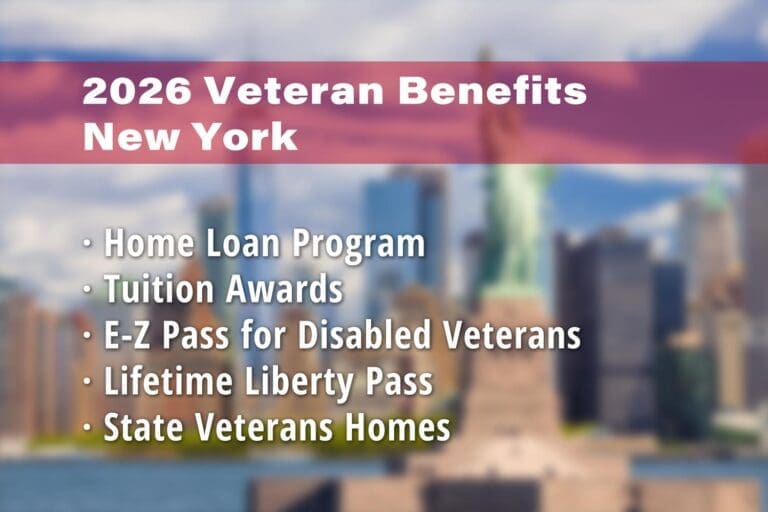

New York State Veteran Benefits

The state of New York makes a concentrated effort to support its military and Veteran residents. While Veterans, Servicemembers and retirees have access to many federal-level benefits, often states must offer their own support of Veterans to assist their military residents with accessing these federal benefits or perhaps filling in any gaps to service and support from federal benefits. New York state Veteran benefits include such programs as the New York state property tax exemption for Veterans, the New York income tax exemption for Veterans, special license plates for designated Veterans, and the New York hunting license for Veterans, among many others. Keep reading to learn more about New York state Veteran benefits. New York Veteran Financial Benefits Former Servicemembers residing in New York have many New York state Veteran benefits available to them, including the New York state property tax exemption for Veterans and the New York income tax exemption for Veterans, especially disabled Veterans. In addition to these tax benefits, Veterans can access programs such as Veteran auto insurance to lower vehicle costs, Veteran life insurance for family protection,